Share price trends of companies listed in the stock market are crucial indicators for investors looking to make informed decisions regarding their investments. Utkarsh Small Finance Bank, founded in 2009, is a relatively new entrant in the Indian financial services sector. As a small finance bank, Utkarsh aims to provide financial inclusion services to underserved and unserved segments of the population.

Understanding Utkarsh Small Finance Bank

Utkarsh Small Finance Bank, with its focus on providing banking services to individuals and small businesses in rural and semi-urban areas, has gained attention from investors looking to capitalize on the growth potential of such segments in the Indian economy. The bank offers a range of financial products and services, including savings accounts, fixed deposits, loans, and insurance, tailored to the needs of its target customer base.

Factors Influencing Utkarsh Small Finance Bank Share Price Trends

1. Financial Performance

One of the key factors affecting Utkarsh Small Finance Bank’s share price is its financial performance. Investors closely monitor the bank’s revenue growth, profitability, asset quality, and capital adequacy ratios to gauge its overall financial health and stability.

2. Economic Environment

The broader economic environment, including factors such as interest rates, inflation, and GDP growth, can impact Utkarsh Small Finance Bank’s share price trends. Changes in these macroeconomic indicators can influence the demand for banking services and the overall profitability of the bank.

3. Regulatory Environment

Regulatory changes and compliance requirements in the banking sector can have a significant impact on Utkarsh Small Finance Bank’s operations and share price trends. Investors need to stay updated on any new regulations or policies that may affect the bank’s business operations.

Analyzing Utkarsh Small Finance Bank Share Price Trends

1. Historical Share Price Performance

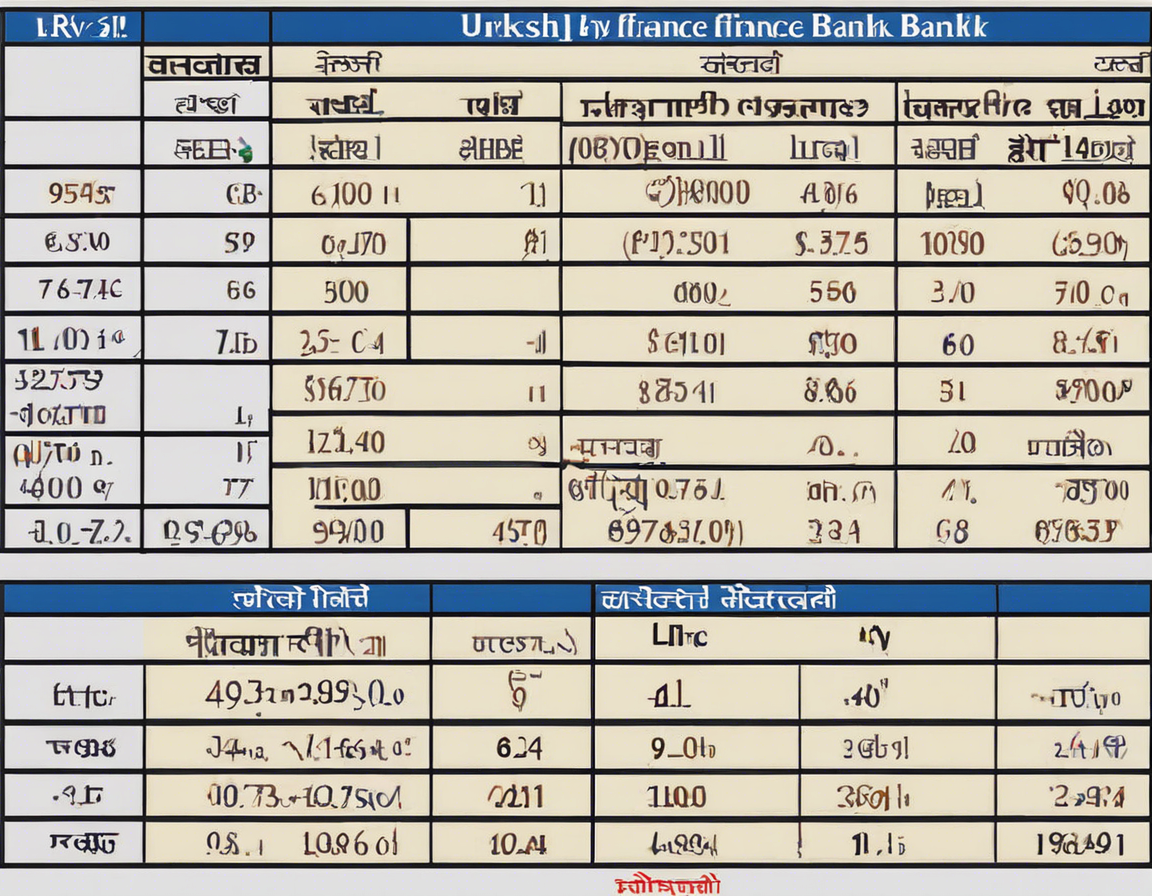

Analyzing Utkarsh Small Finance Bank’s historical share price performance can provide valuable insights into its stock price trends over time. Investors can track the bank’s share price movements, identify patterns, and assess the factors driving its valuation.

2. Technical Analysis

Technical analysis involves studying historical trading data, such as price and volume, to forecast future share price movements. Traders use various technical indicators and chart patterns to analyze Utkarsh Small Finance Bank’s stock price trends and make informed trading decisions.

3. Fundamental Analysis

Fundamental analysis focuses on evaluating Utkarsh Small Finance Bank’s financial statements, business model, competitive position, and industry trends to determine its intrinsic value. Investors use fundamental analysis to assess the bank’s growth prospects and investment potential.

4. Market Sentiment

Market sentiment, including investor perception, news flow, and analyst recommendations, can influence Utkarsh Small Finance Bank’s share price trends. Positive sentiment can drive stock prices higher, while negative sentiment can lead to a decline in share prices.

FAQs:

1. Can I invest in Utkarsh Small Finance Bank shares?

Yes, Utkarsh Small Finance Bank shares are listed on the stock exchange, and investors can buy and sell them through a stockbroker.

2. What are the key factors to consider before investing in Utkarsh Small Finance Bank shares?

Investors should consider factors such as the bank’s financial performance, growth prospects, regulatory environment, and market dynamics before investing in Utkarsh Small Finance Bank shares.

3. How do I track Utkarsh Small Finance Bank’s share price trends?

Investors can track Utkarsh Small Finance Bank’s share price trends by monitoring stock price charts, financial news, analyst reports, and regulatory announcements related to the bank.

4. What are the risks associated with investing in Utkarsh Small Finance Bank shares?

Investing in Utkarsh Small Finance Bank shares carries risks such as market volatility, regulatory changes, economic downturns, and industry-specific risks that can impact the bank’s share price performance.

5. How can I stay informed about Utkarsh Small Finance Bank’s latest developments?

Investors can stay informed about Utkarsh Small Finance Bank’s latest developments by following the bank’s investor relations website, reading financial news, attending analyst calls, and monitoring regulatory filings.

In conclusion, analyzing Utkarsh Small Finance Bank’s share price trends requires a comprehensive understanding of the bank’s financial performance, market dynamics, and regulatory environment. Investors can use a combination of technical and fundamental analysis, along with monitoring market sentiment, to make informed decisions about investing in Utkarsh Small Finance Bank shares.